The following post originally appeared on Forbes.com.

Every serious sports fan knows that “defense wins championships. The Ravens and the Tide are famous for it. In the NBA, all three of the top scoring teams were easily eliminated early in the playoffs by more defensively-minded squads. Great pitching beats great hitting.

You knew that, but maybe you haven’t considered how it works the same way in the investing world.

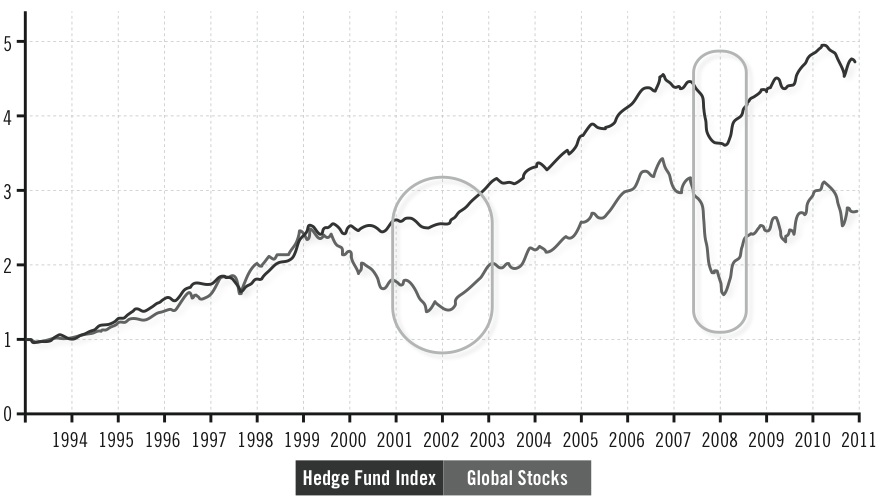

The chart below shows why it is, exactly, that hedged strategies have so vastly outperformed long-only stock investors over the past couple of decades. It isn’t, as is so commonly thought, that hedge funds outperform on the upside: it’s that they lose less in big downturns:

It’s clear: defense wins investing championships, too.

When you think about it, you see that the sports analogy is no accident. There, and in the investing world, it’s much easier to be consistent on defense than when trying to score. Offense performance is more variable and unpredictable, play by play and game by game. It requires athletes to be “on”… and nobody is all the time. (Heck, even LaBron James blew two crucial offensive possessions at the end of the game last Friday). And it’s the same way in finance: even the greatest gurus will make some awful choices.

Moreover, in both, errors don’t just mean that you fail to score: they put you in a hole. In investing, you lose the power of compounding (which is why that chart above looks as it does). In athletics, they create turnovers, the one statistic that separates winners and losers in every sport involving alternating possessions.

Of course, defense does require tremendous discipline, teamwork, and focus; but those are achievable even on an “off” day… in both sports and investing. Defensive consistency is much easier to achieve than lots of points in every game.

So, if not losing money is the key to having more of it over time– as the chart shows– and is also easier to achieve than outsized returns, why don’t more investors spend more time on this side of the ball?

Well, in fact, the world’s most sophisticated investors do. That’s why they have over $2 trillion invested in hedge funds, the bulk of it in “long/short” strategies devised to avoid large losses. (By the way, basic confusion over whether these investors are playing offense or defense is what leads the press to frequently report, with a scowl, that hedge funds have recently underperformed a big market rally.

A reporter who makes that claim may then talk about how many points the local baseball team scored last night).

As for average investors… well, until recently, they haven’t really had a chance to run the same plays. All the specialist fund managers were hiding out in privately placed partnerships, with big minimums, high fees, and long lockups. And even all that didn’t really matter so much, because these investments weren’t allowed to be advertised or offered to the public anyway. Quite literally, who knew?

It’s different today. There are some superb mutual funds running those same long/short strategies that the savviest investors have relied on for years. Many offer low fees overall fees to go with daily liquidity, and are open to nearly everyone. And L/S aside, investors can also play defense by adding non-correlated strategies like global macro, managed futures, real assets, income strategies, and dozens of others that are described in my new book, The Alternative Answer (www.altanswer.com)… and will be here over the coming posts.

So if you want your investing team to play better defense, and you should, consider drafting some of these ideas into your portfolio. Watch the fee load, of course, and ignore the brand name of the fund: what matters is managers with deep experience in the exact strategy they’re running. (Don’t forget: manager performance makes a much bigger difference with alternative strategies than it does in standard stock-picking). And if you want one more tip, look at long/short mutual funds of funds, which will give you manager diversity on top of the basic benefits of the strategy.