Jeremy Hill of TF Market Advisors puts out the excellent weekly Macro Monitor newsletter. Check out this week’s edition below:

Roughly 4.4 million Americans were described as long term unemployed in Friday’s jobs report. That number seems intuitively important in the context of current monetary policy. We believe the fear of structural long term unemployment has been a powerful driver of Federal Reserve policy and we believe it will continue to overlay the FOMC’s calculus on bubbles, growth, market reactions and fiscal politics among other competing concerns. Long-term unemployment, as defined by being out of work for six months or more, and the labor participation rate, which is still stubbornly low at 63.4%, are concerns not vitiated by adding 178,000 private jobs in May.

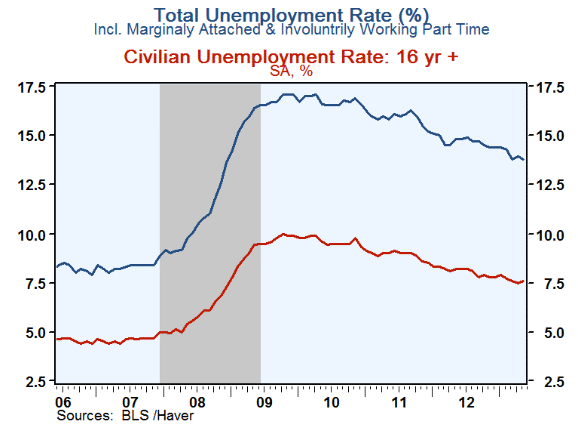

We try not to be obsessed by any singular issue, but we can’t help ourselves from staring at this chart for long periods of time (directly, below):

The Fed has told us about the red line – they need to see 6.5% unemployment for a consistent period to materially change course (whatever that means….). The blue line, U-6, is perhaps more troubling. At what point, do we stop kidding ourselves and understand that a part time job at a big box retailer instead of previous employment as an assistant bank branch manager is simply not the same thing. The Fed is not going to fight that battle, but it is worth considering not just for social policies but also for market meaning. That social ills and discontent will eventually build into a political froth is certainly not priced into the market yet. We don’t see an imminent risk of European style street battles, but we think a dovish leaning Fed’s consciousness extends to many areas technically within their mandates.

We said it in the Macro Monitor two weeks ago post Bernanke testimony: the bias has not changed on QE, but the evidence needed to change the bias has weakened. Unlike many market participants, we don’t see an end to QE this year based upon the first five months of data. If anything, we think Chairman Bernanke would rather overshoot on QE and he is very conscious that previous QE efforts ended and restarted because their ultimate effects were not long enough or powerful enough to bring down the unemployment rate. Bernanke is acting, at least temporarily, as Atlas and any messiness will be the next Chairwoman’s problem, not his.

Credit Spreads and Bond Yields

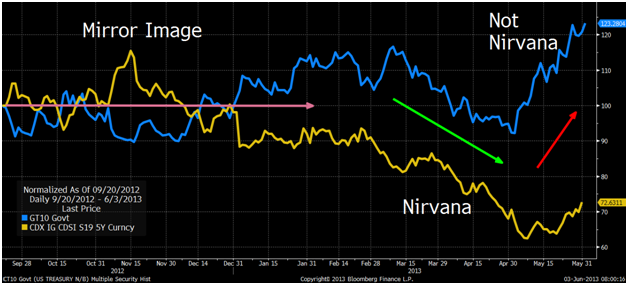

Going back to the creation of IG19 in September 2012, you can see that for the longest time it followed a “risk on”/”risk off” pattern where credit spreads moved in the opposite direction of yields. As yields rose (economy doing better) credit spreads tightened. As yields went lower (economy doing worse) credit spreads rose. There is a certain logic to that which is appealing. Then we entered into this “Nirvana” stage where everything did better. Treasuries, corporate bonds, and stocks all rallied together. High yield did very well as spreads contracted and treasury yields went lower (Chart, below):

Now the opposite is happening – BOTH treasury spreads and yields are moving out! In a world where liquidity can only be described as “phantom” in some corners of the market and outflows in credit funds seemingly increasing, there is a worry that there are no bidders to mop up any cheaper credit assets. Please see our report here: Credit Spreads and Bond Yields.

Credit ETF “Spiral” Risk

Notwithstanding the positive benefit of passive management, many ETFs have been constructed under lose governance strictures and have recently traded in sloppy manners. Some ETFs have suffered institutional malaise and others have simply been misconstrued. We all know the story of complicated ETFs that lose value due to technical issues such as futures roll (e.g., the disaster that is/was TVIX – if unfamiliar, look it up…). With high yield trading lower in the last several weeks, we wonder if some of the aggressively constructed HY ETFs are starting to suffer from “spiral” risk.

At its essence, spiral risk means that arbitrage desks sell the bonds that HY ETFs own when the ETF starts to trade at a significant discount to NAV. Unlike mutual funds, ETF holdings are pretty well up to date so the individual bond holdings of these companies are known. If this type of selling pressure happens across similar ETFs, such as HYLD, JNK and HYG, all three could face redemptions further forcing down the price of the bonds. Please see these two reports for our detailed thinking on this specific risk: Spiral Risk Explained and Yields and Spiral Risks.

High Yield is Getting “Goosed”

High yield as a singular asset class has not performed well in the last several weeks. Again, we find it necessary to take a step back and look at total return performance year to date. As of Wednesday (6/5/13), year to date and on a total return calculation, the Merrill Lynch High Yield constrained index was up 3.7% and triple-C rated paper was up 7.7%. The recent sell off in credit assets has obviously been brought on by interest rate risk. Although, we believe the Treasury market has or will soon stabilize into a new trading range, there is a risk that high yield paper will suffer from the “paradox of credit” where an asset class sell off scares the market back into a risk on/risk off stance which ultimately brings a bid to Treasuries as a safe haven. Please see Bond Bubble Paradox.

In this report (HY ETFs at a Discount) we explain what higher bond yields could mean for HY ETFs that currently trade at a discount to NAV. In addition, we provide some color on our trading philosophy in this report (The Goose Rule).

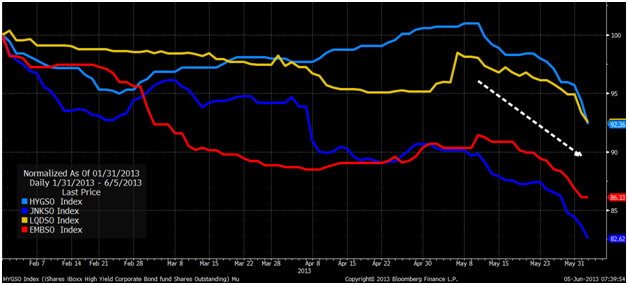

Chart of the Week

This is obviously a concerning chart. Beyond putting readers on notice, we don’t have much commentary to give other than to state that we continue to be in a transient market where good can be bad, and bad can be good due to worldwide central bank easing regimes. Frankly, it feels as if the market has a dearth of focal points other than obsessing about Fed tapering. Counterintuitive thinking says that obsessions mean less preparation in the face of obvious risks and that the magnitude of actions might actually be less than their current hypothetical values. When all is said and done, credit assets will be treated the way they should – as total return products and some bargains will be found in being long and short for savvy market participants.