Content

- What to Look For When Picking a Cryptocurrency Exchange

- What Is the Point of Cryptocurrency?

- What is a Crypto Wallet?

- Join our free newsletter for daily crypto updates!

- Our top crypto play isn’t a token – Here’s why

- What is the spread in cryptocurrency trading?

- What Coins Are Offered?

- Future Regulation

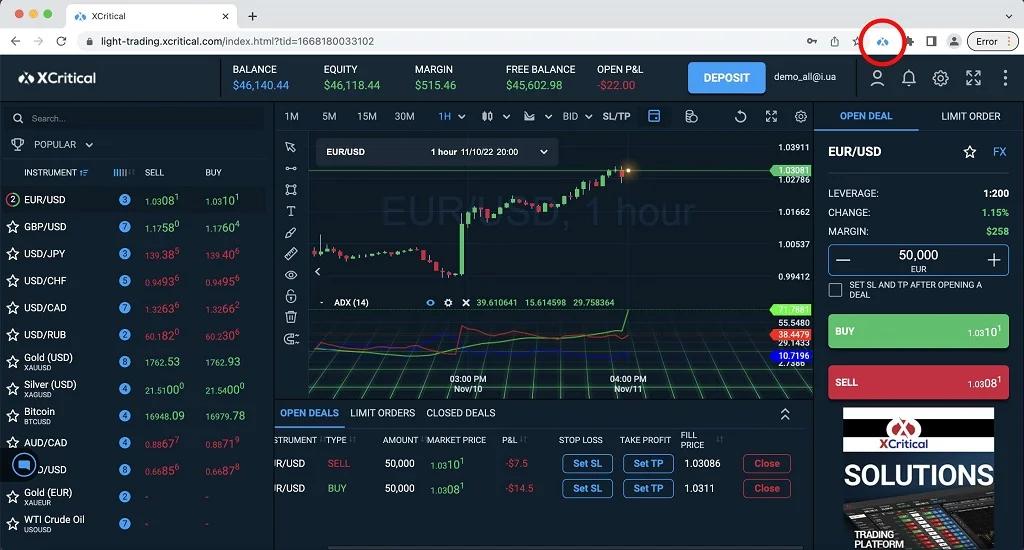

Leverage is the means of gaining exposure to large amounts of cryptocurrency without having to pay the full value of your trade upfront. When you close a leveraged position, your profit or loss is based on the full size of the trade. Mining computers compile valid transactions into a new block and attempt to generate the cryptographic link to the previous block by finding a solution to a complex algorithm. When a computer succeeds in generating the link, it adds the block to its version of the blockchain file and broadcasts the update across the network. Stellar has its own unique protocol known as the Stellar Consensus Protocol for settling transactions across a distributed ledger. Low-cost currency transfers allow easy transactions between any two currencies, which some organizations find attractive as a resilient mechanism for commerce.

- For that reason, it’s important to understand the differences between each exchange platform to find the one that works best for you.

- Investors should review all corresponding information, including the website and white paper.

- Either way, the cost of trading is one of the main points to compare between the different brokers and exchanges.

- This will help you avoid serious in the future or even criminal charges.

- While a public key is like your bank account number and can be shared widely, your private key is like your bank account password or PIN and should be kept secret.

- The company behind it has worked with various banks and financial institutions.

Founded in 2009, Bitcoin was the first cryptocurrency and is still the most commonly traded. The currency was developed by Satoshi Nakamoto – widely believed to be a pseudonym for an individual or group of people whose precise identity remains unknown. Cryptocurrencies run on a distributed public ledger called blockchain, a record of all transactions updated and held by currency holders. While early Bitcoin users were able to mine the cryptocurrency using regular computers, the task has gotten more difficult as the network has grown.

What to Look For When Picking a Cryptocurrency Exchange

In contrast, cryptocurrency is not issued by any government authority. It is typically not directly managed by a single authority but rather works in a distributed consensus approach. It’s going to be increasingly accepted by merchants and customers, and it will continue to have a volatile nature, which means prices will continue to fluctuate, as they have been doing for the past few years. In general, the higher-market-cap coins are more likely to be traded on most exchanges.

In 2020, however, in a landmark decision, the country’s Supreme Court ruled that ban unconstitutional and relented, allowing exchanges to reopen. Cryptocurrencies are not legal tender in India and the status of exchanges remains murky, as new regulations are being considered. Although there is currently a lack of clarity over the tax status of cryptocurrencies, finance minister Bhagwat Karad indicated in February 2022 that cryptocurrency transactions could face a 30 percent tax.

For example, if a user loses one key, there will still be two other keys that are able to sign transactions. As introduced at the beginning of this section, a cold wallet is entirely offline. While they’re certainly not as convenient as hot wallets, they are far more secure. An example of a physical medium used for cold storage is a piece of paper or an engraved piece of metal.

What Is the Point of Cryptocurrency?

In communities that have been underserved by the traditional financial system, some people see cryptocurrencies as a promising foothold. Pew Research Center data from 2021 found that Asian, Black and Hispanic people “are more likely than White adults to say they have ever invested in, traded or used a cryptocurrency.” They share many similarities with cryptocurrencies, and they can be bought and sold in many of the same marketplaces. The investing information provided on this page is for educational purposes only.

Without a backup strategy, you will have no way of getting your cryptocurrency back, and you could lose your investment. It is going to take some research on your part to choose the right wallet for your needs. If you choose to manage your cryptocurrency wallet with a local application on your computer or mobile device, then you will need to protect this wallet at a level consistent with your investment. Just like you wouldn’t carry a million dollars around in a paper bag, don’t choose an unknown or lesser-known wallet to protect your cryptocurrency. Examples of decentralized exchanges include IDEX and Curve Finance.

If you are prone to losing passwords and devices, then it makes more sense to use a custodial wallet, since an exchange or custodian is likely to have better security practices and backup options. That’s why it’s a popular option for beginners who have little to no experience trading crypto. Further, transaction fees with a custodial wallet tend to be cheaper or even free. While a public key is like your bank account number and can be shared widely, your private key is like your bank account password or PIN and should be kept secret. In public-key cryptography, every public key is paired with one corresponding private key. The funny thing is that both lack of regulation and exposure to regulations can turn into risk events for cryptocurrency investors.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform. Information related to lending products contained herein should not be construed as an offer or prequalification for any loan product offered by SoFi Bank, N.A. Think of a crypto exchange as the place where you trade crypto, and a wallet as the place where you “store” crypto — although how a crypto wallet functions is a bit more complex. An exchange that offers insurance could shield investors from losses should anything catastrophic happen, but such policies are not common and they’re typically not extensive.

What is a Crypto Wallet?

For most people, the easiest way to get cryptocurrency is to buy it, either from an exchange or another user. Thoughtfully selecting your cryptocurrency, however, is no guarantee of success in such a volatile space. Sometimes, an issue in the deeply interconnected crypto industry can spill out and have broad implications on asset values. If you’re thinking about getting into cryptocurrency, it can be helpful to start with one that is commonly traded and relatively well established in the market. It’s important to remember that Bitcoin is different from cryptocurrency in general. While Bitcoin is the first and most valuable cryptocurrency, the market is large.

A second check confirms that the sender authorised the transfer of funds using their private key. Cryptocurrency mining is the process by which recent cryptocurrency transactions are checked and new blocks are added to the blockchain. CFDs trading are derivatives, which enable you to speculate on cryptocurrency price movements without taking ownership of the underlying coins. You can go long (‘buy’) if you think a cryptocurrency will rise in value, or short (‘sell’) if you think it will fall. In the United States, the Internal Revenue Service first provided guidance on how cryptocurrency should be handled for tax purposes in 2014.

Join our free newsletter for daily crypto updates!

The change from PoW to PoS occurred in an event known as “The Merge.” Activities on the legacy Ethereum Mainnet blockchain, which used PoW, were merged with the newer Beacon chain, which uses PoS. The goal with the move to PoS is to provide better transaction speed, while reducing the resource required to execute and validate transactions. There are already more than 12,000 cryptocurrencies, and the growth rate is simply astounding. Cryptocurrencies have more than doubled in number between 2021 and 2022.

On the other side are people such as Warren Buffet, Paul Krugman, and Robert Shiller, who are against it. Krugman and Shiller, who are both Nobel Prize winners in the field of economics, call it a Ponzi scheme and a means for criminal activities. The users who check the transaction to see whether it’s valid or not are known as miners. After this is done, the transaction and several others are added to the blockchain, where the details cannot be changed.

Our top crypto play isn’t a token – Here’s why

The Division of Financial Institutions regularly issues “non-binding statements” to virtual currency businesses ruling on whether the businesses must be licensed. These statements can be found on theDepartment of Finance’sweb site. Our legal analysts provide data-rich, actionable perspectives on these key issues. Think about what happens if your computer or mobile device is lost or stolen or if you don’t otherwise have access to it.

OECD Crypto Tax Plans and Implications: What’s Coming in 2023 – BeInCrypto

OECD Crypto Tax Plans and Implications: What’s Coming in 2023.

Posted: Tue, 20 Dec 2022 09:30:00 GMT [source]

NextAdvisor may receive compensation for some links to products and services on this website. At NextAdvisor we’re firm believers in transparency and editorial independence. Editorial opinions are ours alone and https://xcritical.com/ have not been previously reviewed, approved, or endorsed by our partners. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors.

\r\nOn the flip side, many scammers also target these kinds of platforms to advertise and lure members into trouble. Get in touch with us for a free consultation and preliminary project estimate. Our team will help you define the next steps and better understand how to organize the development process. Asynchronous architecture involves many separate layers that pass their own requests without waiting for responses. As a result, the user interface receives status updates and users don’t have to wait for responses. Asynchronous architecture provides unlimited scalability, which makes it a perfect choice for ambitious projects.

Additionally, we have in place a total of US$360 million for insurance protection of customer funds. In addition to the wallets mentioned above, wallets can be further separated into custodial and non-custodial types. On the flip side, many scammers also target these kinds of platforms to advertise and lure members into trouble. By checking this box, you agree to the Terms of Use and Privacy Policy & to receive electronic communications from Dummies.com, which may include marketing promotions, news and updates.

What is the spread in cryptocurrency trading?

The wallets are the tool through which you store your encryption keys that confirm your identity and link to your cryptocurrency. Otherwise, fraudsters may pose as legitimate virtual currency traders or set up bogus exchanges to trick people into giving them money. Another crypto scam involves fraudulent sales pitches for individual retirement accounts in cryptocurrencies.

What Coins Are Offered?

A blockchain file is always stored on multiple computers across a network – rather than in a single location – and is usually readable by everyone within the network. This makes it both transparent and very difficult to alter, with no one weak point vulnerable to hacks, or human or software error. Blockchain technology has unique how to create a cryptocurrency exchange security features that normal computer files do not have. A learning experience platform is an AI-driven peer learning experience platform delivered using software as a service (… For a monthly fee, the Coinbase exchange added an indemnification option up to $1 million, and time will tell if other exchanges follow suit.

This was the result of a large theft of bitcoins that were stolen straight out of the Mt. Gox hot wallet over time, beginning in late 2011. In contrast to other Latin American countries, Mexico does, to an extent, regulate cryptocurrency exchanges through the Law to Regulate Financial Technology Companies. The law extends Mexican AML regulations to cryptocurrency services providers by imposing a variety of registration and reporting requirements. Cryptocurrencies are broadly considered legal across the European Union, but cryptocurrency exchange regulations are different in individual member states. Cryptocurrency taxation also varies but many member-states charge capital gains tax on cryptocurrency-derived profits at rates of 0-50%.

With regard to the FTX debacle in 2022, internal chicanery caused a meltdown . An online trading platform that is used to buy, sell and exchange cryptocurrencies. Exchanges convert fiat currency (dollars, Euros, etc.) to crypto (Bitcoin, Ethereum, etc.), and vice versa.